FS-2024-0742 | July 2025

Understanding Choices: Navigating Consumer Education for a Better Tomorrow

By Troy Anthony Anderson, Ed.D.

Consumer choices depend on basic needs and wants. Consumers who tend to make responsible decisions are most likely to be satisfied with their long-term choices. However, the individual consumption of goods and services can potentially influence the choices of others in a positive or negative manner. The art of choosing in this instance explores the multifaceted nature of decision making. It delves into how consumers make choices and the role of choice for families. Families associated with an individualistic culture outside of the United States may be amazed to learn that what they view as a frustrating lack of choice in collectivist cultures is actually seen as reassuring and more likely to result in fairness by those in the alternative economy (Guess, 2004). As consumers navigate these cultural perspectives and the intricate dynamics of decision making, they encounter an ever-expanding marketplace that offers a plethora of goods and services to satisfy both individual and collective needs.

Given these conditions, shopping wisely is a critical asset to the savvy consumer. Consumers encompass a wide demographic range, spanning from young to old, as well as those who have traditional versus online marketplace preferences. However, it is important to note that each member of the family has unique consumer needs and preferences. These needs and wants tend to be met according to the family’s savvy capability to procure them. In a family, basic needs should always be met before each individual’s wants. Hence, the family as a unit needs a guide to help them clarify and spend for needs versus wants.

Wise practices of the savvy consumer include:

- Make purchases that will meet the needs of all family members.

- Use all available goods and services with care.

- Plan ahead by making a budget and sticking to it.

- Create a shopping list and be sure to compare various costs across different types of brands (generic brands, store brands, and national brands).

- Don’t focus on the cheapest option. Compare prices to ensure you are getting the best value for your money.

- Conduct an online search to see if the business is reliable and read any consumer reviews. Note that some reviews are bot-generated and not written by consumers or actual humans.

- Purchase goods in season and preserve foods for when out of season through drying, freezing, canning, dehydrating, pickling, or any other preservation method.

- Use your phone and calculate your purchase’s total, including taxes. Always take your change, even if your change is only a quarter. Remember the old saying. “A penny saved is a penny earned.”

- After shopping, retain the receipts in case a product is defective, or you need to return it.

The savvy consumer possesses extensive knowledge in marketing and advertising, enabling them to discern and resist deceptive sales tactics, such as “buy one, get one” offers or other gimmicks that entice consumers into purchasing unnecessary products. This knowledge forms the bedrock of effective consumer education.

The Value of Consumer Education

Consumer education involves teaching the head of the household about family resource management through Extension programming, community resources, and various forms of mass media such as television, radio, newspapers, magazines, advertisements, and product demonstrations. Consumer education is critical to families and involves the following:

- Learning about financial literacy to understand the economy, managing finances, and using credit wisely.

- Understanding the marketplace and its trends.

- Learning about inflation, product placement, and pricing.

- Discussing strategies to get value for money.

- Practicing consumer responsibilities.

- Exploring appropriate behavior for consumer safety.

- Knowing the rights of the consumer.

Understanding the Rights of the Consumer

Knowing your consumer rights is essential for being an educated consumer. The concept of professional regulation serving the public interest is summarized in the “Consumer Bill of Rights,” first introduced by President John F. Kennedy in 1962 (Lampman & Douthitt, 1997):

- The right to safety: to be protected against the marketing of products and services that are hazardous to health or to life.

- The right to be informed: to be protected against fraudulent, deceitful, or grossly misleading information, advertising, labeling, or other practices, and to be given the facts needed to make informed choices.

- The right to choose: to be assured, whenever possible, of access to a variety of products and services at competitive prices.

- The right to be heard: to be assured that consumer interests will receive full and sympathetic consideration in making government policy, both through the laws passed by legislatures and through regulations passed by administrative bodies.

Other rights formulated in the same context by consumer organizations include:

- The right to consumer education: to have access to programs and information that help consumers make better marketplace decisions.

- The right to redress: to work with established mechanisms to have problems corrected and to receive compensation for poor service or for products which do not function properly.

- The right to a healthy environment: the right to a physical environment that will enhance the quality of life. This right acknowledges the need to protect and improve the environment today and in the future.

- The right to basic needs: the right to basic goods and services which guarantees survival: food, clothing, health care, education and sanitation.

Consumer Protection

The consumer is protected by several government laws and regulations. These include:

| Law/Regulations | Description |

|---|---|

| Health Regulations | Reduces danger to the public in the manufacturing, distribution, or sale of food. |

| Food, Drug & Cosmetic Act | Protect consumers from unsafe and unhealthy food and drugs. |

| Food Hygiene Regulations | Prohibits the sale of food which is diseased or contaminated. |

| Care Labeling Rule | Requires manufacturers and importers of textiles to provide care instructions to purchasers. |

| Weights and Measures Regulation | Ensures that customers are provided with the exact weight, measurement, and number of any product purchased. |

| Dodd Frank Act | Provides safeguards for American families to prevent exploitation via predatory practices from mortgage firms and payday lenders. |

| Gramm-Leach-Bliley Act | Requires financial institutions providing services such as loans, insurance, or investment advice to explain their practices to the customers and to safeguard sensitive data. |

There are multiple laws within the United States that are designed to shield consumers from fraud, faulty products, and invasions of data privacy. For example, while not prohibiting negative options outright, the Restore Online Shoppers’ Confidence Act (ROSCA) establishes certain criteria to guarantee that the purchaser is fully aware and consents to the terms outlined by the vendor. Certain agencies and institutions also provide consumer safety education that assists community members with important information and lessons that enable them to make informed choices and to seek redress for grievances. Some of these agencies and institutions include:

- Cooperative Extension: Through Extension programming, land-grant universities bring theoretical information, practical experiences and solutions to the community. In addition to the various Family & Consumer Sciences (formerly Home Economics) programs offered, most Cooperative Extensions such as the University of Maryland Extension (UME) have a program focused on financial wellness and capability to manage resources wisely.

- Office of the State Attorney General: Receives and handles complaints to protect consumers and to enforce consumer protection laws. Each state has a consumer protection service division, often within the Office of the State Attorney General that also investigates complaints against unethical businesses while educating the community about their rights and responsibilities.

- Better Business Bureau: Provides consumers with information on businesses and charities operating in the public realm. It also handles consumer complaints about firms where consumers may have a grievance on how business is conducted.

- The Federal Trade Commission (FTC): Works to stop deceptive and fraudulent business practices based on consumers’ report. Once a report is filed, the FTC conducts an investigation, suing companies and people that break the law. Additionally, the agency is responsible for developing rules to maintain a fair marketplace as well as educating consumers and businesses about their rights.

- Consumer Financial Protection Bureau (CFPB): Acts as a catalyst for consumer action and empowers consumers to protect themselves in the marketplace. The agency also works to enforce federal consumer financial laws ensuring that markets for consumer financial products are reasonable, competitive, and transparent.

- The National Consumer League (NCL): A non-profit organization that advocates for consumers in matters related to the marketplace and workplace. The NCL provides businesses, government among other agencies with consumer concerns as it relates to child labor, medication information, food safety and privacy.

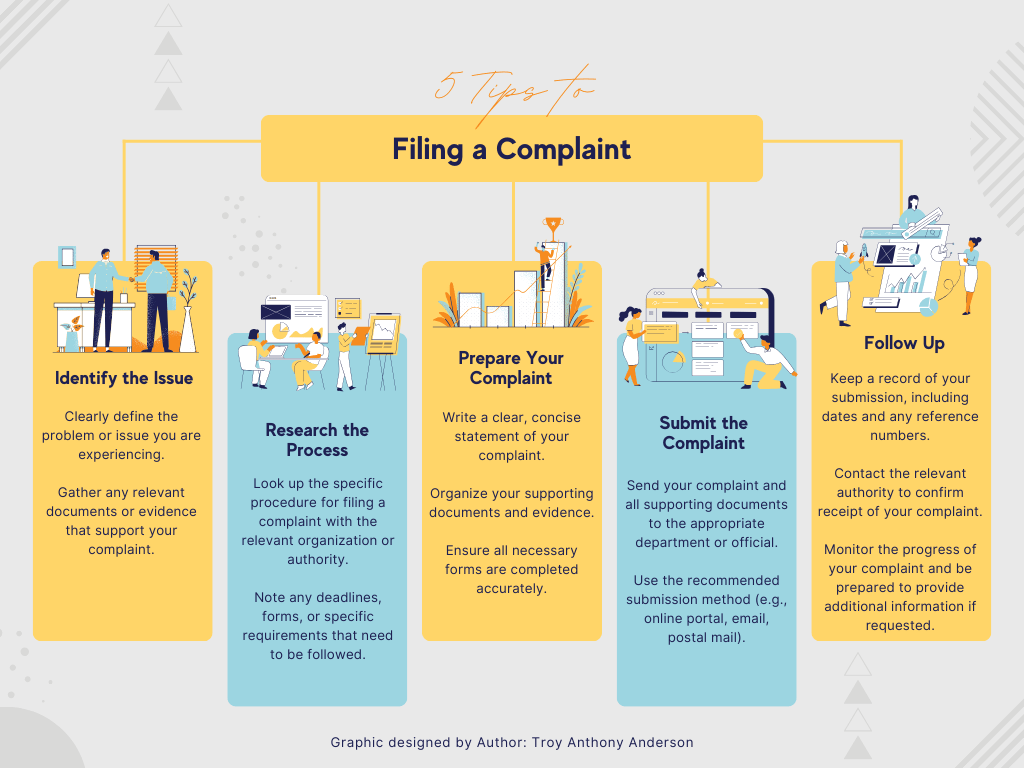

While this list is not exhaustive, it offers guidance for consumers to understand the roles and functions of some of the organizations that provide education about their rights and options when dissatisfied with a service or a purchase. Most consumers do not like to file complaints as the process can become tedious. However, some consumers find it necessary to complain at one point or another about poor service or quality of a product. Consumers can get full or partial redress in a timely fashion if they know their rights. Five tips to filing a complaint are as follows:

Guarantee Vs Warranty

To effectively navigate these situations, it’s crucial for consumers to be aware of the types of assurances that accompany their purchases, such as guarantees or warranties. A guarantee or warranty is similar to a contract. This is the manufacturer’s certified statement that the product being sold will perform at high quality over a specified period of time. The range of time can vary among different manufacturers and products; some are as short as three months from the time of purchase to one or more years. It is worth noting that in certain scenarios, the contract’s validity may extend to either the product’s market lifespan or the lifespan of the initial buyer which can last decades. The contract of sale is typically with the initial buyer, who must seek redress from the manufacturer for the product. Thus, if the consumer feels like the product is defective, they should return the item as soon as possible and communicate with the manufacturer. As a result, understanding the type of contract that is associated with a purchase is of utmost importance.

The terms warranty and guarantee are often used interchangeably, but there are subtle differences between the two. The difference between a guarantee and a warranty is their legal standing. A guarantee is essentially a promise or an assurance from the manufacturer or seller that the product will function as described and meet certain quality standards. In contrast, a warranty is a guarantee with an obligation from the seller that states if their product fails to meet certain specifications, a remedy will be made available. Regardless of their differences, both guarantee and warranty contracts require the manufacturer or seller to act on promises made to consumers about product offerings. For this reason, the Magnuson-Moss Warranty Act of 1975 protects consumers from fraud and misrepresentations. In the realm of product manufacturing, guarantees and warranties come in different types, namely:

- Implied Warranty: Tends to be automatically presumed during the sale of the product, unless the seller explicitly renounces the warranty using specific language such as “as is” or “with all faults.” There are various types of implied warranties such as:

- Implied warranty of merchantability: Promises that goods are fit to be sold.

- Implied warranty of fitness: Promises that the product is fit for a particular use.

- Implied warranty of habitability: Provides renters with a habitable dwelling.

- Express Warranty: Oftentimes included in the written terms of the product contract clearly stating promises in regard to the product’s condition and performance. Extended Warranty: An additional warranty that can lengthen the manufacturer’s original warranty.

- Lifetime Warranty: Covers the lifespan of the product.

- Limited Warranty: Usually contains specific restrictions on what can and cannot be covered under various conditions.

- Retention Guarantee: A guarantee that safeguards the refund process for the consumer’s deposit in the event that the seller is unable to fulfill their obligations.

- Performance Guarantee: The guarantee that a product purchased or service used will meet specific standards.

Consumers should always take care of products purchased in an effort to get value for their money. If the product has been damaged by the consumer not following instructions, the manufacturer or seller is not obligated to take responsibility. The guarantee will not cover any damages or ruins that were caused by not following safety procedures on printed labels or instruction manuals.

Responsibilities of the Consumer

Consumers have rights, but they also have responsibilities. You as a consumer should always observe the following, as failing to do so violates local, state, or federal regulations and could lead to serious consequences:

- Adhere to posted signage in stores that prohibit eating and smoking; these signs are there to maintain a clean and safe environment for all customers and staff.

- Steer clear of any temptation to take something without paying for it.

- Switching price tags on goods is theft.

- Sale items must retain their original labels; do not detach them.

In addition, consumers should follow these best practices:

- Keep food and other packaged commodities intact; avoid any damage to the packaging.

- Adhere to all safety guidelines and product labeling instructions.

- Return any surplus change you may have received in the transaction.

- Properly dispose of used products to minimize waste and protect the environment; utilize recycling programs where possible.

- Report genuine issues using the proper channels to maintain integrity and avoid submitting false information which could lead to delays or penalties.

Consumer Practices

The preferences of consumers are shaped by the primary needs and desires of the family unit they come from. Consumers who make responsible decisions while buying are likely to be satisfied with the choices they make. Yet, how consumers use things within the family can impact other household members, either positively or negatively. This conduct sometimes can lead to conflict within a family. On a community level, individual consumers can also make large purchases of items where scarcity exists, leaving other consumers with little to no resources.

While individual consumer behavior can affect both family dynamics and community resources, financial habits also play a crucial role in household stability. For example, some people borrow money continually. They take one loan after the other, becoming habitual borrowers in the spirit of the adage, “Robbing Peter to pay Paul.” As a savvy consumer it is critical that the family makes a budget and lives within their means. Living on credit is risky, as balances that are carried month to month can rise as the result of increasing interest charges. Additionally, families should avoid wasteful practices that could be harmful to themselves and their community.

The aim of the consumer is to achieve and experience their full potential from the use of goods and services. According to Lee, Lee, & Kim (2020), quality goods and services add to the quality of life and sense of wellbeing for the consumer. However, the quality of life varies among consumers because of their values, goals, resources available, and management of goods and services. Individuals with different lifestyles may have different consumption patterns. Someone who is weight conscious may consume foods from a low-calorie diet, while someone who is a farmer may be interested in agricultural tools. The consumer’s lifestyles have a significant influence on their desires for certain goods and services. Some other factors that may influence the consumers’ choice to buy or spend may include, but are not limited to:

- Knowledge and information about a particular goods or service.

- Total number of family members in the household.

- Climate, especially as it relates to food and clothing.

- Age of the various family members.

- Health of the family members.

- The amount of money available for needs and wants.

Consumer Safety

High standards of safety should be the number one priority for consumers. The federal government has enabled specific laws and regulations for the safety of consumers within the marketplace that are enforced by various government agencies and institutions. Since all products have the potential to cause harm to the consumer, the Consumer Product Safety Commission was established to protect the public from unreasonable risks. In order to comply with existing legislation, businesses and manufacturers invest time to thoroughly evaluate any and all potential hazards or risks that a consumer may encounter while using the goods or service. For example, toy manufacturers need to ensure that their products are non-toxic and dyes used are free from toxins. Electrical gadgets, tools, and equipment must carry safety features such as plugs with a third/ grounded prong, circuit breakers, and GCFI outlets alongside an instruction manual.

Federal health regulations also deal with consumer safety related to manufacturers’ distribution and sale of goods or medicines which may or may not require a health provider’s prescription. These regulations determine whether a health provider’s prescription is necessary for certain products, thereby reducing the consumer’s potential misuse or overconsumption. Additionally, legislation regulates the number of additives and preservatives placed in food as well as those who can handle food. By maintaining rigorous health standards in environments where food is prepared or sold, these regulations help prevent contamination and health risks. This type of comprehensive evaluation varies across the board but allows proactive safety measures on the manufacturer or seller’s part to minimize risks and protect consumers.

Understanding consumer safety means being aware of the choices available and the options chosen. Educated consumers can critically analyze product labeling, compare different options, and make informed decisions based on factors such as safety regulations, manufacturer reputations, and potential hazards. As a result, consumers who are empowered with knowledge can navigate the complexities of product safety, and make informed decisions that align to their wellbeing. As we move toward a future where informed choices are the norm, the collaboration between consumers, manufacturers and regulators is pivotal in promoting a healthier and more secure tomorrow.

References

- Guess, C. D. (2004). Decision making in individualistic and collectivistic cultures. Online readings in psychology and culture, 4(1), 3.

- Lampman, R. J., & Douthitt, R. A. (1997). The consumer bill of rights: Thirty-five years later. Advancing the Consumer Interest, 4-6.

- Lee, J. M., Lee, J., & Kim, K. T. (2020). Consumer financial well-being: Knowledge is not enough. Journal of Family and Economic Issues, 41(2), 218-228.

TROY ANTHONY ANDERSON

tanders4@umd.edu

This publication, Understanding Choices: Navigating Consumer Education for a Better Tomorrow (FS-2024-0742), is a part of a collection produced by the University of Maryland Extension within the College of Agriculture and Natural Resources.

The information presented has met UME peer-review standards, including internal and external technical review. For help accessing this or any UME publication contact: itaccessibility@umd.edu

For more information on this and other topics, visit the University of Maryland Extension website at extension.umd.edu

University programs, activities, and facilities are available to all without regard to race, color, sex, gender identity or expression, sexual orientation, marital status, age, national origin, political affiliation, physical or mental disability, religion, protected veteran status, genetic information, personal appearance, or any other legally protected class.

When citing this publication, please use the suggested format:

Anderson, T.A., (2025). Understanding Choices: Navigating Consumer Education for a Better Tomorrow (FS-2024-0742). University of Maryland Extension. go.umd.edu/FS-2024-0742