FS-1181 | October 2021

Health Insurance Claim Problem? How to Navigate the Health Insurance Claims Process

When you receive health care services, medical devices, or prescriptions, you or your provider will submit a claim to your health insurance company. A claim is a request to your health insurance company to pay for an item or service that you think is covered. It is similar to a bill. Most health insurance plans must cover a wide range of 10 services called the Essential Health Benefits. However, health insurance plans have different rules about the health providers you can use, the services covered, how much you pay, and how much they pay. Sometimes, they can refuse to pay a claim or end your coverage.

What Happens If Your Health Insurance Company Declines to Pay a Claim?

If you feel your claim was wrongly denied, you have the right to appeal the decision, but the process can be confusing. Two key considerations make a difference in the claim and appeal processes:

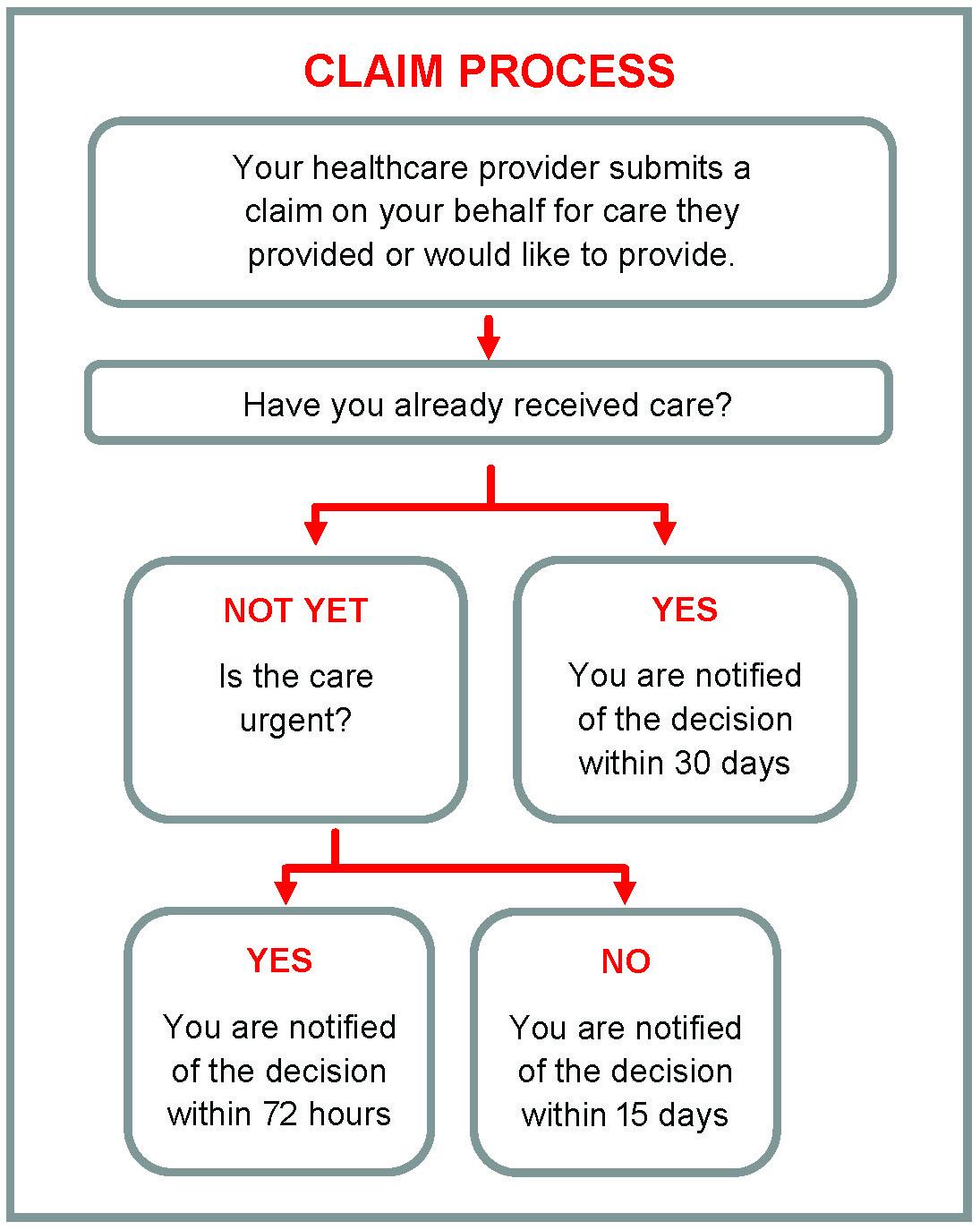

- Have you already received the care, service, device,or prescription?

- Is the care urgent?

Figure 1 will help guide you through the claims process.

How Does the Claim Process Start?

When you visit the doctor, your healthcare provider may file a claim with your health insurance company on your behalf for the treatment they have provided or would like to provide. Sometimes your provider gives you the paperwork to file the claim yourself. The insurance company must decide if they are going to pay for the service, medication, or device within a certain number days. The time depends on whether you have had the care yet, and if the care is urgent.

- If you have already received care, the insurance company must notify you of the claim decision within 30 days.

- If you have not received care and the medical situation is urgent, you must be notified within 72 hours.

- If you have not received care and the medical situation is not urgent, you will be notified of their coverage decision within 15 days.

In all situations, if your health insurance company refuses to provide coverage, you have a right to appeal the decision.

How Does the Health Insurance Appeal Process Work?

The first step in the appeal process is an internal appeal (Figure 2). An internal appeal is usually initiated by notifying your health insurance company in writing. Either complete all required forms from your health insurer, or send them a letter explaining your situation along with your name, claim number and health insurance ID. Include supporting documents, such as a letter from your doctor that may help your claim. You must file this claim within 180 days (6 months) of receiving notice that your claim was denied. Once filed, the insurance company is required to review its decision.

- If you have not yet received care and your health concern is urgent, you will be notified of your internal appeal result within 4 days, and you also have the option to file an external claim review at the same time.

- If you have not received care and the medical situation is not urgent, you will be notified of their coverage decision within 30 days.

- If you have already received treatment, you will be notified of the internal appeal decision within 60 days.

If Your Claim is Still Denied After the Internal Review, You Can Continue Your Appeal by Filing an External Review.

An external review means that an organization outside of your insurance company is going to be responsible for deciding if your insurance company must pay for the service, medication, or device (Figure 3). You must file an external appeal in writing within four (4) months of denial notification from the internal appeal.

Every state has an approved external review organization. Instructions for filing an external review will be on the claim denial letter you received after your insurance company’s internal review.

Just like the internal appeal, you must receive notification from the external review:

- Within 72 hours response if you have not yet received care and you have a medically urgent case.

- In writing within 45 days if care is not urgent, or you have already received

care.

If you are having difficulties filing an appeal, your state’s Consumer Assistance Program (CAP) or Department of Insurance may be able to provide assistance.

| DOROTHY NUCKOLS dnuckols@umd.edu CATHERINE SORENSON cjrsoren@umd.edu LISA MCCOY lmccoy@umd.edu REBECCA AJIBOYE This publication, Health Insurance Claim Problem? Conflict? How to Navigate the Process (FS 1181) is a part of a collection produced by the University of Maryland Extension within the College of Agriculture and Natural Resources. The information presented has met UME peer-review standards, including internal and external technical review. For help accessing this or any UME publication contact: itaccessibility@umd.edu For more information on this and other topics, visit the University of Maryland Extension website at extension.umd.edu University programs, activities, and facilities are available to all without regard to race, color, sex, gender identity or expression, sexual orientation, marital status, age, national origin, political affiliation, physical or mental disability, religion, protected veteran status, genetic information, personal appearance, or any other legally protected class. |