Most farms at one time or another experience cash flow problems. The cash flow budget is one of the best ways to pinpoint these problems, but it will not solve cash flow problems, rather it reveals symptoms of problems. Measures can then be taken to deal with the actual problems. The following are some methods for dealing with cash flow problems.

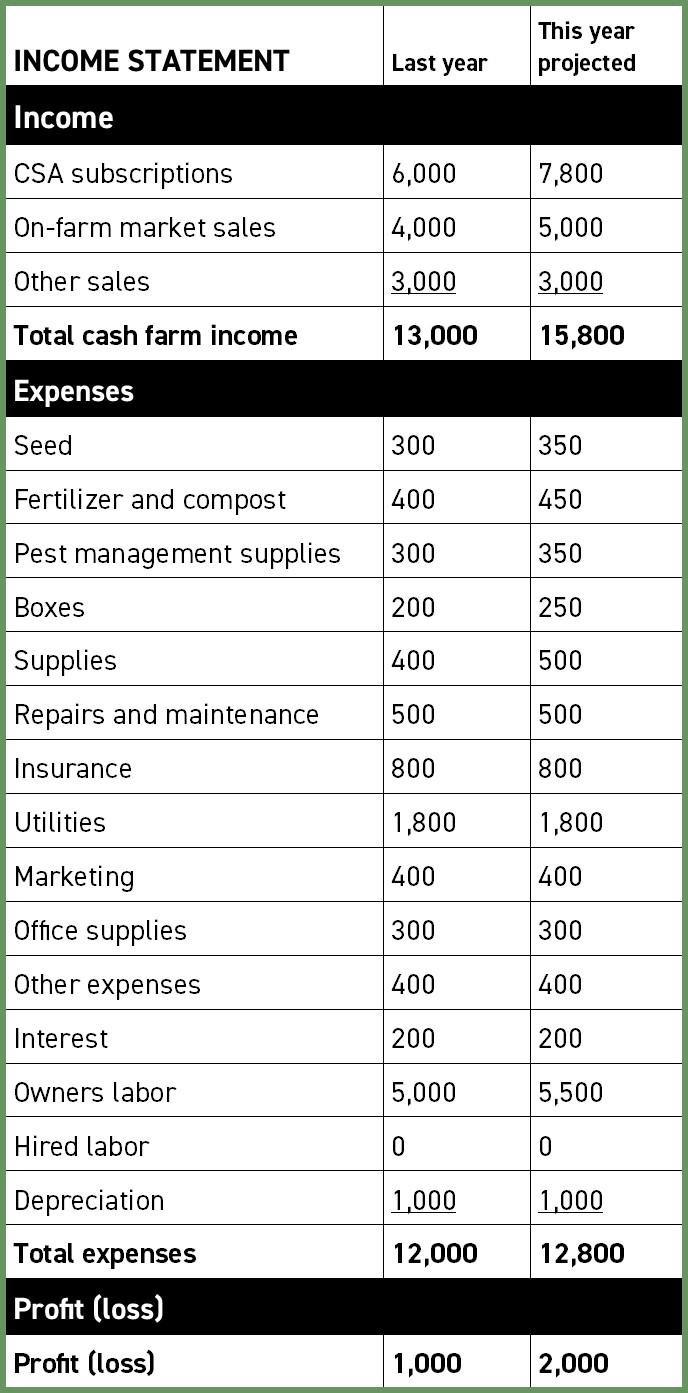

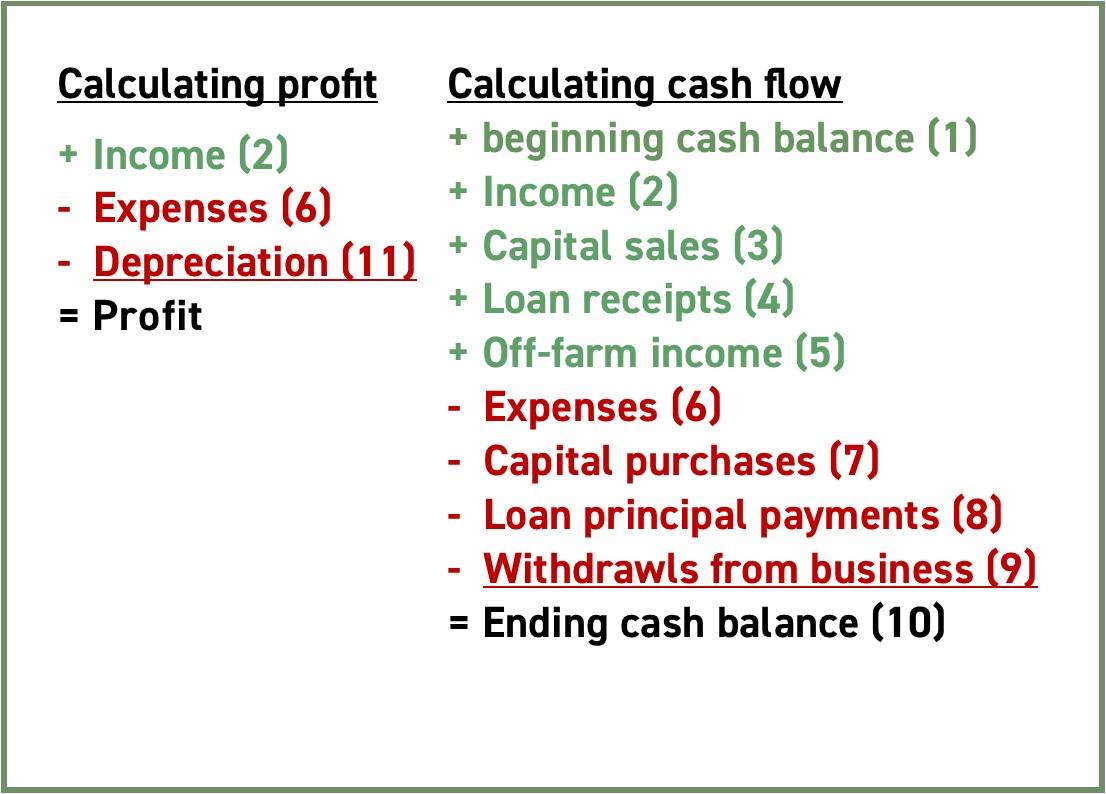

Improve profitability - Cash flow problems may be the symptom of the greater problem of low profitability. In approaching cash flow problems, first analyze profitability. Increasing profitability is often the best way to remedy cash flow problems. Once the farm is profitable, you can then concentrate on cash flow problems. However, in adopting strategies to remedy cash flow problems, be sure these strategies do not adversely affect profitability. For example, borrowing money to solve a cash flow problem will result in additional interest expense that can hurt profitability. Treating cash flow problems at the expense of profitability is a short term remedy that may have detrimental long term effects.

Prevent the problem - It is important to identify cash flow problems before they occur. This "preventative medicine" will allow time to alter plans and remedy the problems by timing cash inflows and cash outflows. It's useful for determining the best method to maintain cash reserve. There is no one strategy that will work at all times. Rather, a combination of strategies is the basis for solving cash flow problems.

Consider alternative enterprises - Carefully look at the combination of enterprises on the farm. Perhaps another enterprise would increase cash flow while at the same time maintaining profitability. For example, putting a greater focus on spring vegetables may generate cash flow during a time when there are a lot of crop inputs to purchase. Value-added products and agritourism are other ways to create additional enterprises based on existing resources.

Managing expenditures - A very effective way to improve cash flow is through cost control, for example, postponing capital purchases. You should frequently check to see if levels of inputs are economical. Are the best seeds and seeding rates being used? Is fertilization at an economically optimal level or are you applying too much fertilizer? Can commercial fertilizer be reduced through better management of compost or livestock wastes? Would an investment in mulch pay for itself in reduced time spent weeding? Can labor be better utilized to decrease expensive capital outlays? Is there better machinery that would improve labor efficiency? Can machinery costs be cut through reduced tillage methods? Can repair bills be reduced through on-farm repairs? Can interest costs be lowered through better loan rates or timing of loans? Every cost should be scrutinized to determine if it can be reduced without adversely affecting profitability.

Improving marketing plans - Improving farm profitability should be the main goal in formulating a marketing plan. As mentioned before, poor marketing is one of the main reason for business failure.

Leasing or renting - The down payments and loan payments associated with purchasing land, buildings and machinery sometimes put a heavy burden on cash flow. Leasing or rental payments may be considerably lower and will free cash that is needed for other obligations. However, assess the impact of these leasing and rental arrangements on profitability of the farm operation.

Reduce business withdrawals - If you are withdrawing profits from this business for personal use, carefully review the amount you are withdrawing. Record all personal expenditures. Many individuals are surprised by how much they spend for personal living expenses. Distinguish between necessities and wants. Postpone unneeded personal expenditures. Base personal withdrawals on the performance of the farm business and/or off farm income. Be realistic in determining the amount of personal withdrawals the farm can support.

Off-farm employment - Rely more on part-time or full-time employment off the farm. Off-farm employment may also include health care insurance and other benefits. Carefully consider any additional expenses related to off-farm employment such as transportation, clothing, child care, etc.

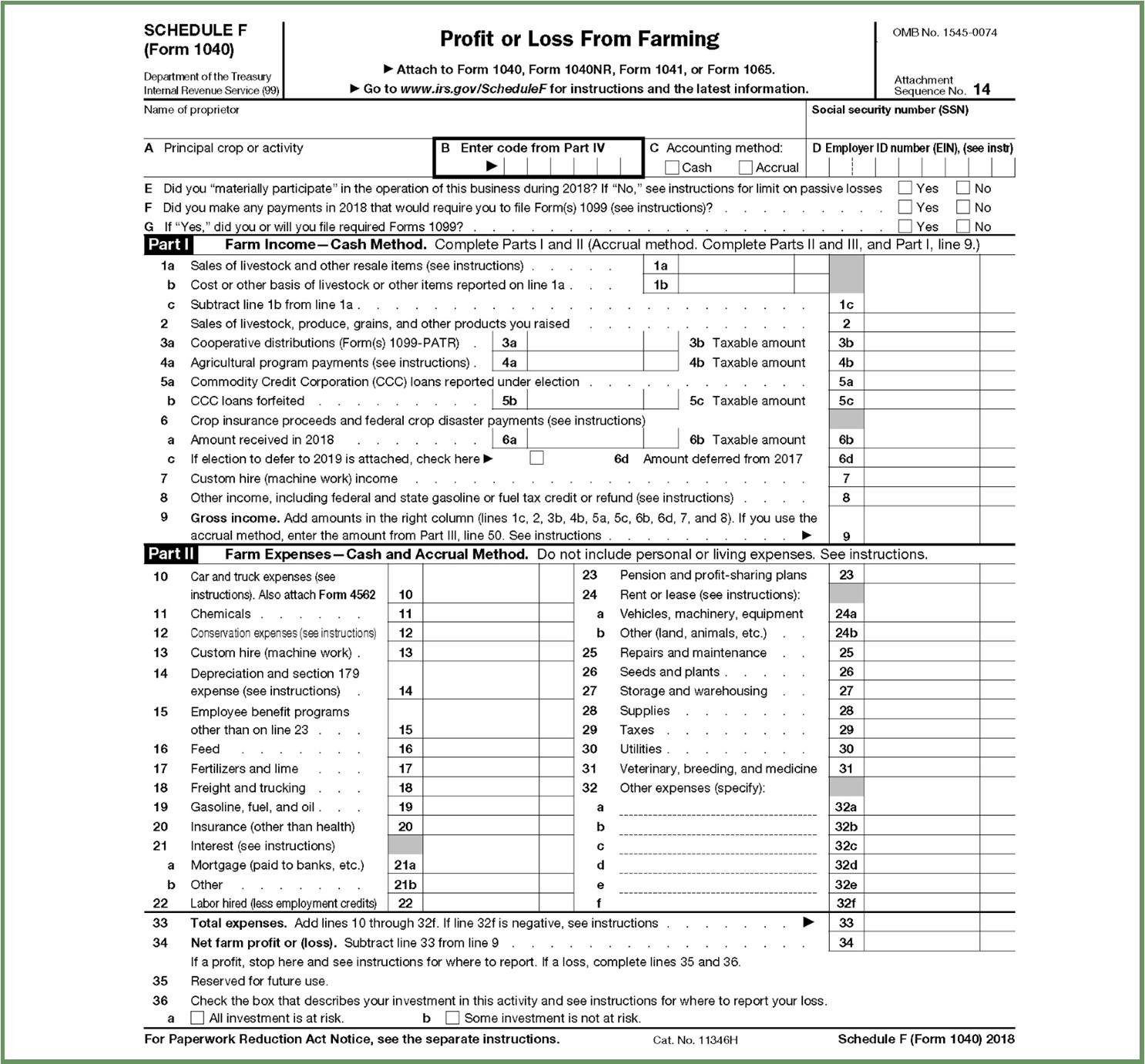

Refinancing - Cash flow problems are sometimes caused by too much short term debt on the farm. For example, some farmers use credit cards or short term operating loans to finance long term assets. Normally credit cards or operating loans are used to purchase variable inputs such as seed, transplants, feed, fertilizer, compost, row covers, etc. Every effort should be made to pay off the credit card or loan balances as the farm produce is sold to minimize interest expenses. Credit cards or operating loans should not be used for long term assets such as equipment or structures because the receipts from one production period cannot be expected to cover the costs of assets that last several production periods. The idea of self-liquidating loans suggests that a proper financing program for loans would synchronize the input's life and pattern of earnings with the length of repayment schedule on the loan used to obtain the input. That is the reason that farm equipment is financed for five to seven years. Financing it for a shorter period may cause cash flow problems. If adverse weather conditions result in insufficient receipts to cover the operating loan, rolling this loan over to the next year may cause cash flow problems. Perhaps the loan should be refinanced over a longer period so the cash shortfall can be absorbed over several production periods. Refinancing can effectively deal with cash flow problems but sometimes it may just be buying time. If the farm is not profitable, refinancing is a warning flag to indicate the problem is being prolonged.

Liquidating assets - Selling capital assets is usually a more drastic measure for dealing with cash flow problems. However, it may be justified. Sell unprofitable assets first. Excessive personal assets, unused machinery, unproductive land, etc., are good candidates. Consider downsizing the operation through selling off excess capital, but only after doing an in depth long term financial analysis of the impact of these corrective actions. Do not sell assets without discussing it with creditors who have a lien on those assets.

Maintaining credit reserves - One should always maintain a credit reserve. If a farmer borrows to the limit, bills will accumulate and creditors will line up at the door. When experiencing cash flow problems let creditors know what is being done to solve the problems. Avoiding creditors may just aggravate the problem.

Maintain or improve credit scores - Check your credit score with the major credit bureaus to see if there are any weaknesses that will make it more difficult to get loans from lenders who rely upon these scores to make their loan decisions. Over time, it is possible to improve credit scores through good credit management. This will increase borrowing capacity.

Grants, fundraising, and recruiting investors - A grant or investment will not make an unprofitable organization profitable. Before applying for a grant or recruiting investors, start by working through the financial statements in this chapter. Ask yourself the following questions:

- How much is the shortfall between my current income and my current expenses?

- What expenses do I need to fund?

- How would my use of that funding change my operation to eliminate that shortfall after the funding has run out?

Any funder, whether a granting agency or a loan officer or an investor, will want to know how their funds will be used, and what their return will be on their investment. Loan officers and investors will expect their investment to be paid back with interest. Granting agencies will expect their funds to be used to make measurable impact on the issues specified in the grant Request for Applications (RFA) or Request for Proposals (RFP). In general, granting agencies like to fund new, exciting projects. Grants usually cannot be used to pay for annual operating expenses, and almost no grants allow for capital purchases such as buildings, land, or large pieces of equipment.