FS-2025-0770 | December 2025

The Influence of Cognitive Dissonance on Financial Value Clarification

By Troy Anthony Anderson, Ed.D., Extension Educator, Calvert County.

Understanding the intricate relationship between cognitive dissonance and financial value clarification is key to achieving a harmonious financial life. Cognitive dissonance, a theory first introduced by Leon Festinger in 1957, refers to the mental discomfort experienced when an individual holds two or more contradictory beliefs, values, or attitudes, especially as it relates to behavioral decisions and attitude change (Minquan, 2024). Financial value clarification, on the other hand, involves identifying and prioritizing one’s financial goals and values to ensure that financial decisions align with personal beliefs and long-term objectives. When applied to personal finance, this theory becomes a powerful lens through which we can examine how our internal conflicts may hinder our financial success.

Cognitive dissonance often emerges in financial decisions when there is a clash between our deep-seated values and the actions we take. For example, if an individual values being economical with money but habitually makes impulsive purchases, they may experience dissonance between their spending behaviors and their financial values. This dissonance can lead to stress and anxiety, affecting overall life satisfaction (Cooper, 2023). Therefore, to mitigate the effects of cognitive dissonance, it is essential for individuals to clarify and align personal values with their financial goals.

According to Simon & Howe (2009), clarifying one’s values can serve as a compass, guiding individuals through the financial decision-making process. When values and goals are aligned, individuals are more likely to make decisions that lead to financial well-being and satisfaction (Lannello et al., 2021). For instance, someone who values security might prioritize savings and investments over luxury spending. This alignment reduces dissonance as every financial decision reinforces their core values, leading to a more cohesive and satisfying financial life (Kessler, 2010). Moreover, setting clear financial goals that reflect one’s values can act as a roadmap, providing direction and motivation (Joshi, 2025). Financial experts who examine the relationship between values and financial decisions find that aligning these elements not only promotes satisfaction but also mitigates the psychological strain caused by a form of cognitive dissonance called financial dissonance.

The Psychological Impact of Financial Dissonance

Financial dissonance can have profound psychological effects, beginning with the process of financial value clarification. Financial value clarification involves identifying and understanding one’s financial values and priorities, enabling the formulation of informed decisions in line with those values. This process is essential in mitigating cognitive dissonance, as it allows individuals to clearly articulate what they value most in their financial lives, thereby reducing conflicting behaviors and emotional distress. As a result, the psychological impact of financial dissonance should not be underestimated. When individuals experience dissonance, it can lead to chronic stress and anxiety, which negatively affect mental health and overall well-being (Al-Adamat et al., 2022). Understanding the psychological aspects of financial decision-making can aid in developing strategies to cope with and reduce dissonance. The psychological impact of cognitive dissonance on finances extends beyond decision-making to include various emotional and mental health consequences such as:

- Stress and Anxiety: The tension arising from conflicting financial behaviors can lead to heightened stress and anxiety. Constantly justifying poor financial decisions can drain emotional resources and heighten feelings of guilt or inadequacy.

- Reduced Financial Satisfaction: Individuals experiencing cognitive dissonance may find it challenging to achieve financial satisfaction. The gap between their financial reality and their financial aspirations can lead to chronic dissatisfaction and discontent.

- Impact on Self-Esteem: Financial dissonance can also affect self-esteem. When individuals perceive themselves as financially responsible yet consistently engage in irresponsible financial behavior, their self-esteem may suffer, leading to a negative self-image.

A comprehensive analysis of the interaction between financial dissonance and the wider framework of cognitive dissonance, particularly as it pertains to individual values and aspirations, is crucial for a deeper understanding of this topic. By identifying the telltale signs of cognitive dissonance, individuals can achieve a greater sense of financial well-being and satisfaction. This understanding empowers individuals to make more informed decisions, aligning their financial actions with their core values. However, financial dissonance, with its profound psychological effects, underscores the importance of aligning one’s financial behaviors with their underlying values and goals.

Understanding Cognitive Dissonance in Financial Contexts

One often hears the words values and goals mentioned together, as they are deeply interconnected. Values are the deeply rooted beliefs an individual hold about what is good and desirable. These values are shaped by one’s experiences at home, within religious practices, and through community interactions. Importantly, values are personal and unique; what holds significance for one person might not resonate with another.

Throughout life, individuals continuously make choices influenced by their values, which in turn affect how they manage their finances. To achieve true satisfaction, it is crucial for goals to align with personal values. This doesn’t mean that every value must be linked to a financial goal; rather, values should serve as a guiding framework when setting goals. When conflicts arise, and financial decisions must be made, considering one’s core values can provide clarity and direction to overcome cognitive financial dissonance.

A goal is an objective that one intends to fulfill, a specific aspiration aimed at satisfying a felt need. However, it only becomes a true goal when action is taken to achieve it. Setting goals offers numerous advantages, including the following:

Chart 1: Benefits of Goal Setting

- Provides direction and purpose: Goals give individuals a sense of direction, guiding them towards their desired outcomes.

- Encourages self-understanding: The process of setting goals helps individuals gain insights into their own desires and motivations.

- Identifies needed changes: Goals illuminate areas of life that may require adjustment or improvement.

- Improves self-confidence: Achieving goals can significantly enhance one’s self-esteem and confidence.

- Improves planning: Setting goals requires careful planning, leading to more organized and efficient resource management.

- Defines priorities: Goals help individuals prioritize what is most important in their lives.

- Guides decision-making: Having clear goals helps make informed and purposeful decisions.

- Increases chances of success: With well-defined goals, individuals are more likely to achieve their desired outcomes.

Goals can be categorized in various ways, such as by the different areas of life to which they relate. These areas might include educational and career aspirations, social relationships, personality development, physical fitness, personal appearance, emotional well-being, or financial status. Although it may feel like many goals are imposed by others, they only become personal goals when one accepts them. Believing in the value of a goal and understanding that its attainment will satisfy personal needs is crucial. Suitable goals heavily rely on self-awareness and should align with one’s interests and abilities to be truly beneficial.

Financial goals differ among individuals because each person’s relationship with money is unique and shaped by various personal, cultural, and environmental factors. Some individuals may spend money impulsively due to immediate gratification needs or societal pressures, which can result in uncertainty about their financial situation. On the other hand, some people establish overly rigid financial goals driven by a desire for control or fear of financial instability. This rigidity, while well-intentioned, can lead to dissatisfaction if it limits their ability to enjoy life’s experiences or adapt to changing circumstances. By understanding these diverse approaches, individuals can strive to find a balance that aligns with their values and promotes financial well-being. Ideally, goals should provide a framework that allows for flexibility and maximizes satisfaction from each dollar spent. We can effectively classify goals based on their time horizons: consider the difference between rapidly attainable goals and those requiring a sustained, long-term commitment. Goals can typically be divided into short-term, mid-term, and long-term categories:

- Short-term goals: These are goals related to regular living expenses, such as monthly rent and food costs. An emergency fund for unexpected expenses might also fall into this category.

- Mid-term goals: These involve purchases planned for the near future, like a new coat, gifts, or an appliance. They can be adjusted according to income. For example, a financial counselor might advocate that a client eliminates all debt to enable creating long-term goals.

- Long-term goals: These are ambitions for the next five, ten, or twenty years. While fewer in number compared to short-term goals, long-term goals are generally broader and less specific, such as buying a new home, planning for children’s college education, or preparing for retirement.

To effectively align financial strategies with personal or organizational values, it is crucial to summarize short, mid-, and long-term goals in finance, ensuring that each step forward resonates with and supports the overarching principles and priorities that guide the processes involved in value clarification.

Value Clarification

A person’s value can help them decide their short, mid-, and long-term goals. The goal they set for themselves is formed from the basis of their values. What does this mean? For example, when a person thinks about a career, they often decide on a pathway based on their aptitudes or available resources. Therefore, a person will pursue courses in school that will help them meet the requisites to get accepted into a certain college, university, trade school, or to advance in a specific program area. Ultimately, their personal values are the factors they are most likely to consider when choosing the trajectory of their career.

However, many people are unaware of their values, even though these values affect their decision-making skills. Therefore, clarifying one’s values will help create a principle or standard for making decisions or acting in a certain manner. A person’s values should be directly tied to their goals so they can have a road map to get them where they need to be in the future. If their values align with the goals set and they spend or save money with these goals in mind, they will have greater life satisfaction. The chart below shows some core values that can be prioritized when setting financial goals. Consider factors like consistent saving and strategic investing to achieve one’s goals.

Chart 2: Examples of Values

Core values can include but are not limited to:

- Activeness

- Alertness

- Art

- Leadership

- Ingenuity

- Imagination

- Humor

- Love

- Resourcefulness

- Selflessness

- Competition

- Dynamism

- Freedom

- Poise

- Amusement

- Mellowness

- Creativity

- Education

- Spontaneity

- Wealth

- Adventure

- Achievement

- Challenge

- Outdoors

- Courage

- Dexterity

- Enthusiasm

- Growth

- Happiness

- Security

- Intensity

- Practicality

- Speed

- Synergy

- Learning

- Patience

- Pragmatism

- Realism

- Teamwork

- Travel

The values listed in the chart are merely a guide. It is lengthy and contains many synonyms that may not be applicable to a particular individual based on their unique situation. After identifying one’s core values, create a “top 5” list and from that list, select the most important value. Next, consider the following questions to clarify financial values.

Six (6) Questions to Clarify Financial Values

- Why is the specific value identified from your top 5 important to you?

- What is a short-term goal related to the value selected?

- What is a mid-term goal related to the value selected?

- What is a long-term goal related to the value selected?

- What are some barriers associated with achieving these goals?

- How can you overcome the barriers and still achieve these goals?

To effectively bridge the exploration of financial values and the practical application of addressing cognitive dissonance in personal finance, it’s essential to recognize how deeply intertwined these concepts are, understanding that our values significantly influence our financial decisions and how we rationalize them. The six questions above can further assist individuals in clarifying their financial values and aspirations. By identifying key values and setting corresponding goals, individuals can take meaningful steps towards aligning their financial actions with their personal beliefs. However, as they embark on this journey, they may encounter financial cognitive dissonance - an inconsistency between their values and financial behaviors (Olsen, 2008). This is where practical steps and financial education become crucial, offering tools and insights to harmonize one’s financial mindset with their intrinsic values, ultimately leading to more consistent and satisfying financial decisions.

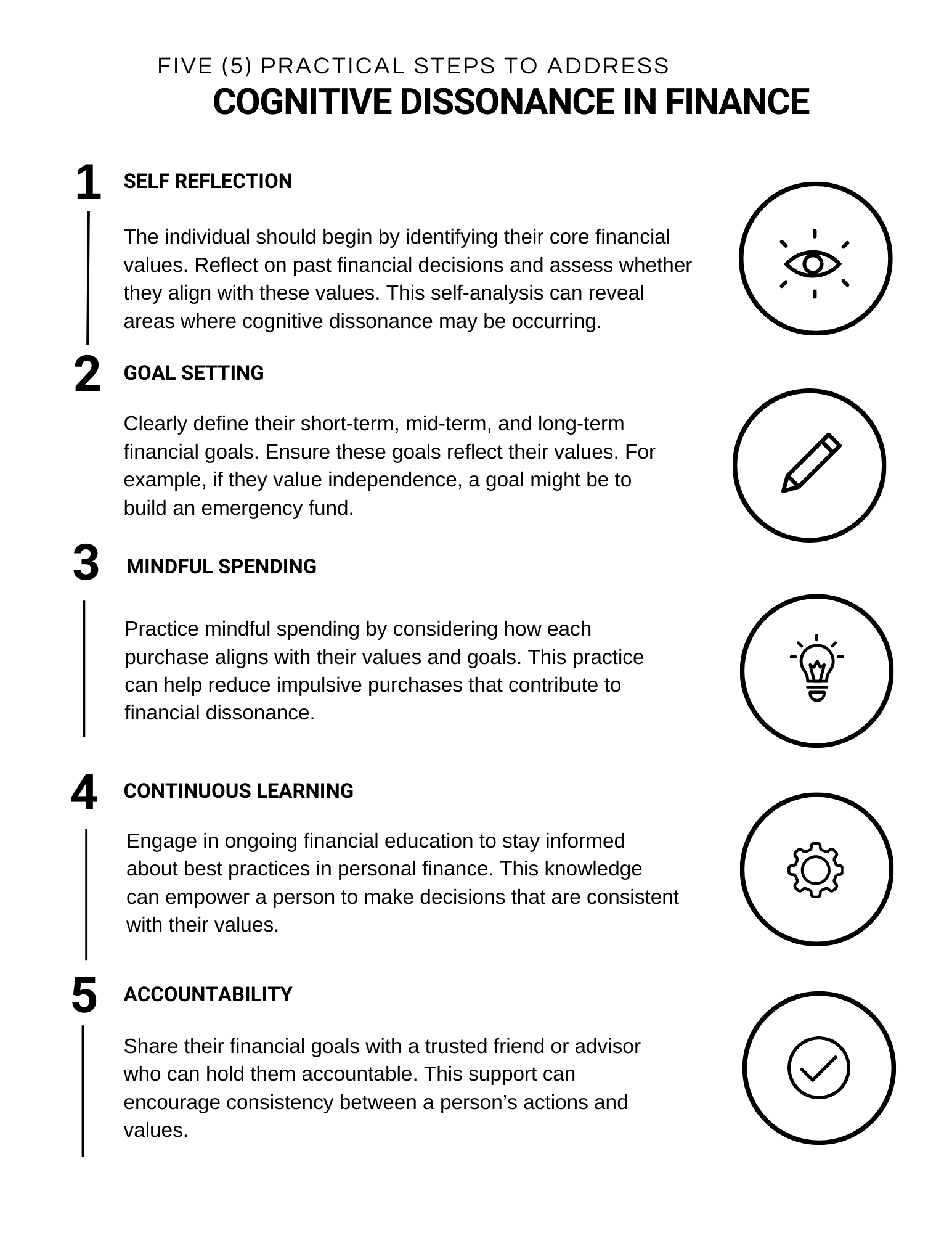

Practical Steps to Address Cognitive Dissonance in Personal Finance

Financial education plays a crucial role in helping individuals identify and clarify their financial values. By enhancing critical thinking and decision-making skills, financial literacy programs can equip individuals with the knowledge necessary to make informed financial decisions. These programs often emphasize the importance of understanding personal values and how they influence financial goals, thus reducing cognitive dissonance (Barta, Gurrea, & Flavián, 2023). Additionally, financial education can help individuals develop a financial mindset that is resilient to external pressures and temptations. This mindset aids in maintaining consistency between one’s values and action steps, thereby minimizing dissonance. Figure 4 presents five steps that can help to create an effective financial mindset.

Unlocking Your Financial Future: Achieving Your Financial Goals

Achieving your financial goals might seem daunting, but with a clear plan and an effective financial mindset, you can unlock your financial future. Follow these strategies to embark on a journey towards financial success:

- Clearly identify and document the specific goals to be achieved. If, for example, a family’s goals include purchasing a new appliance in the coming year, each aspect of the goal should be well-defined and include detailed descriptions such as the style, color, size, and brand name where applicable.

- Establish the cost associated with achieving your goal. Determine the precise monetary cost, how long it will take to save for the goal, and the level of effort required. How much are you willing to spend? Are there any potential trade-offs or opportunity costs to consider here? In the realm of financial education, understanding the concepts of trade-offs and opportunity costs is essential for making informed financial decisions. These concepts help individuals evaluate the implications of their choices, enabling them to better align their decisions with their personal values and financial goals. A trade-off is the notion that to gain something, you must give up something else. An opportunity cost is closely related to a trade-off and represents the value of the next best alternative that is sacrificed when a choice is made.

- Determine a specific date by which you aim to accomplish your goal to track your progress effectively. Set measurable goals with clear deadlines; ensure they are realistic and attainable within the specified time constraints.

- Automating your savings is a powerful strategy to help you achieve financial goals effortlessly. By setting up automatic transfers from your checking account to a savings or investment account, a person can ensure that a portion of their income is consistently allocated towards their financial goals.

- Evaluate your current financial standing by listing your income from all sources, detailing your expenses, and calculating the sum of your debts. Then, create a budget that aligns with your goals, allowing you to track progress and make necessary adjustments.

In conclusion, unlocking a financial future is a complex journey that hinges on achieving one’s 7financial goals, addressing cognitive dissonance, and clarifying personal values. By taking practical steps to confront cognitive dissonance in personal finance, individuals can align their actions with their financial objectives, ultimately fostering a more harmonious financial lifestyle. Understanding cognitive dissonance within financial contexts provides insight into the mental conflicts that can hinder financial progress, while value clarification helps individuals prioritize their spending and saving habits in alignment with their core beliefs and long-term aspirations (Kessler, 2010). Together, these elements form the foundation of a healthy financial mindset, empowering individuals to secure a prosperous future with confidence and clarity.

References

Al-Adamat, O. A., & Atoum, A. Y. (2022). Cognitive dissonance and its relationship to emotional intelligence. Cognition, Brain, Behavior, 26(4).

Barta, S., Gurrea, R., & Flavián, C. (2023). Using augmented reality to reduce cognitive dissonance and increase purchase intention. Computers in Human Behavior, 140, 107564.

Joshi, M. (2025). Motivation and Action: Key Concepts. Educohack Press.

Kessler, A. (2010). Cognitive dissonance, the Global Financial Crisis and the discipline of economics. Public Law, 95, 128.

Lannello, P., Sorgente, A., Lanz, M., & Antonietti, A. (2021). Financial well-being and its relationship with subjective and psychological well-being among emerging adults: Testing the moderating effect of individual differences. Journal of Happiness Studies, 22(3), 1385-1411.

Minquan, C. (2024). Cognitive Dissonance Theory. In The ECPH Encyclopedia of Psychology (pp. 1-3). Singapore: Springer Nature Singapore.

Olsen, R. A. (2008). Cognitive dissonance: the problem facing behavioral finance. Journal of Behavioral Finance, 9(1), 1–4. https://doi.org/10.1080/15427560801896552

Simon, S. B., & Howe, L. W. (2009). Values clarification. New York: Hart Pub. Co.

TROY ANTHONY ANDERSON, ED.D.

tanders4@umd.edu

This publication, The Influence of Cognitive Dissonance on Financial Value Clarification (FS-2025-0770), is a part of a collection produced by the University of Maryland Extension within the College of Agriculture and Natural Resources.

The information presented has met UME peer-review standards, including internal and external technical review. For help accessing this or any UME publication contact: itaccessibility@umd.edu

For more information on this and other topics, visit the University of Maryland Extension website at extension.umd.edu

University programs, activities, and facilities are available to all without regard to race, color, sex, gender identity or expression, sexual orientation, marital status, age, national origin, political affiliation, physical or mental disability, religion, protected veteran status, genetic information, personal appearance, or any other legally protected class.

When citing this publication, please use the suggested format:

Anderson, T.A. (2025). The Influence of Cognitive Dissonance on Financial Value Clarification (FS-2025-0770). University of Maryland Extension. go.umd.edu/FS-2025-0770