There are many incentives available to make installing a small wind system more affordable. However, there are still significant costs associated with small wind systems. Before purchasing a small wind system, it is recommended that you consider the following factors:

- Objective for Purchasing a System — The “acceptable” return on investment in a small wind system will vary by consumer and is largely dependent on your objectives. If your objective is to build a demonstration project, the financial return may not be as important as it would be if your objective were to lower your utility bills.

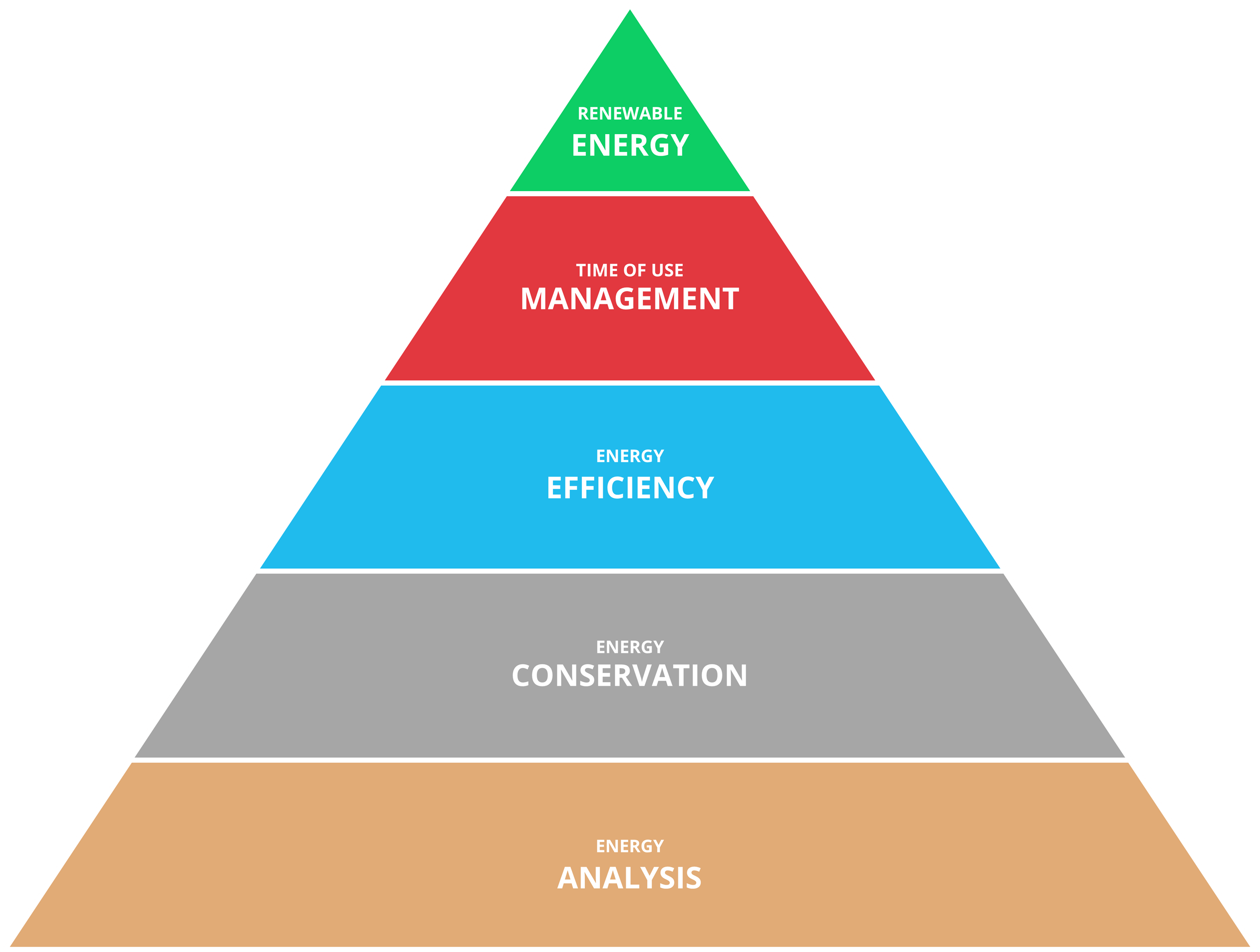

- Energy Efficiency — Start by increasing energy efficiency. Whether trying to reduce your carbon footprint or working to reduce your total energy bill, energy efficiency measures usually help you to reach your goals faster than installing a renewable energy system.

- Total Cost — While many factors influence total cost, system costs range from $4,000 to $8,000 per kilowatt of installed capacity. The estimated cost for a 10-kilowatt system, which would offset most of the electrical consumption of the average home in Maryland, would be $40,000 to $80,000.

- Access to Capital — Even though it may be possible to offset 30 to 75 percent (depending on the state) of the system cost with subsidies, consumers will need to either pay cash or finance the entire cost of the system because of the timing of these incentives. Consumers who do not have access to capital will find the purchase of a small wind system difficult. Be aware that many price quotes list the price of the system AFTER rebates. Many rebates will not be received until after the system is installed. Understand when each incentive will be available.

- Terms of Available Incentives — Pay attention to the terms of incentives. Here are some examples:

- Tax Rebate Incentives: Many incentives are tax credits. You should check with a competent tax advisor regarding the benefit of the tax credit in your particular situation. Check to see if you have sufficient tax liability to use the full value of the tax credit in the first year. Some credits may be carried forward into future years if you do not use the entire amount in year one. However, you will continue to make payments on the system while waiting for the tax incentive. Cash flow assumptions need to reflect the time lag.

- Reimbursement Incentives: Some programs require you to submit receipts for payment. Reimbursement programs may be able to process your incentive payment quickly, but be aware of possible delays.

- Manufacturer or Dealer Financing: Some installers will carry the financing for the amount of benefit a consumer is set to receive. For example, if a consumer appears to qualify for a 30 percent rebate, the installer may agree to carry that 30 percent until the rebate is received. Some installers will also offer financing if you appear to qualify for tax rebate incentives. Be sure to ask about these incentives and make sure you understand the terms that are being offered by the installer. Also, make sure you check with your tax accountant regarding your tax liability to ensure that you will receive the benefit and be able to make payments to the installer.

Common Means of Evaluating Wind Turbine Economics

First Cost

A first (or initial) cost analysis simply compares alternatives of the total upfront investment you will make in a system. A first cost estimate typically includes estimates of the tower, turbine, site work, wiring, and installation costs. A range of $4,000 to $8,000 per rated kilowatt (kW) is typical (for example, the cost of a five kW system would range between $20,000 and $40,000). Costs vary depending on type of equipment used. For example, shorter towers and guyed wire towers are often less expensive than taller, freestanding towers. Similar comparisons can be made for other components as well. The first cost method is a poor method of economic analysis because it only provides information on the total upfront cost and does not look at the longer-term implications of the investment, such as energy production and maintenance costs.

Simple Payback

An investment’s simple payback is calculated by dividing the total cost of the system by the annual net savings. In some cases, the total cost is the cost of the system after incentives (grants, tax credits, etc.). Net savings is the value of the energy generated less operation and maintenance (O&M) expenses. O&M costs are sometimes estimated in terms of cost per kilowatt-hour (kWh) of electricity production. Some estimates use $0.001 to $0.02 per kWh. Other methods estimate the cost of O&M based on the initial turbine cost, such as, one to three percent of the initial purchase cost (one percent of a $50,000 system would result in an annual O&M estimate of $500). O&M costs will vary on the type of equipment. As the number of “moving parts” increase, so should your estimates of O&M expense. For example, if the turbine includes a gearbox, estimates for O&M should be increased to account for wear and replacement of gearbox components. When calculating economic return, it is a more conservative approach to assume higher O&M costs.

Example:

- Capital cost: $50,000

- Value of Energy: 16,500 kWh (estimated electricity generation) x $0.09/kWh (cost of electricity) = $1,485

- O&M: $50,000 (capital cost) x 1.5% = $750 (per year)

- Payback: $50,000 ÷ ($1,485-$750) or $50,000 ÷ $735 = 68.02 years

- With incentives to off-set 45 percent of capital cost = $27,500 ÷ $735 = 37.41 years

Simple payback is an easy calculation but does not always account for many important factors such as increases in energy prices or alternative uses for the project capital.

Cost of Energy (COE)

The cost of energy method combines the capital cost and the total expected O&M (for the life of the project) divided by the total lifetime energy production of the turbine.

Example (Using a 20-year lifespan):

- Capital Cost: $50,000

- O&M: $750(50,000 x 1.5%) x 20 years = $15,000

- Lifetime Production: 16,500 kWh x 20 years = 330,000 kWh

- COE: ($50,000 + $15,000) ÷ 330,000kWh = $0.197/kWh

- If a 30-year lifetime is assumed, the COE drops to $0.146/kWh. If incentives offset 45 percent of the capital costs, then the COE over 20 years is $0.128 kWh.

COE is also considered a simple method in that it does not consider interest payments incurred from the purchase of the system, which increases the COE. This model also neglects increases in O&M expenses. It does not account for the time value of money; however, it is another means of quick evaluation to provide an indication of economic return.

Net Present Value (NPV) and Internal Rate of Return (IRR)

Most companies considering an investment in a project evaluate and compare the profitability of a project based on the net present value of the project or the project’s internal rate of return. Both of these methods estimate the cash flow generated by a project for each year the project is expected to last. This cash flow includes purchase prices, tax incentives, value of electricity, insurance costs, maintenance costs, and any other related income or expenses. For net present value calculations, the net cash flow for each period (including any salvage value of the equipment at the end of the project) is then discounted at a rate (often the expected inflation rate), back to the time of the system’s purchase and added together. If the value is positive, the project is often accepted. For internal rate of return calculations a discount rate is selected that makes the NPV calculation equal to zero. The higher the rate the better financial return of the proposed project. These methods provide a more accurate analysis of a project but both are only as accurate as the data used to generate them.

A net present value (NPV) analysis first estimates a project’s revenue and expenses for each year of the project. In the example below, the project costs $2,500 to purchase today. At the end of each of the next four years, the project will generate revenue of $1,200 and an expense of $200. The revenue and expenses are combined in each year to calculate the net annual cash flow. Each net annual cash flow is then discounted by using a discount rate and the number of years until each expected cash flow. The formula used to discount each net annual cash flow is:

Annual Net Cashflow ÷ Discounted Value

Here, the discounted value is:

Discounted Value = (1 + Discount Rate) ^ Number of Years

NPV is calculated by adding all of the discounted cash flows. A positive NPV indicates the lifetime cash flow of the project is expected to provide a return greater than the discount rate. A negative NPV would indicate the project is expected to provide a return less than the discount rate. It is not common to proceed with a project with a negative NPV.

Net Present Value Example (Discount Rate: 5%)

| |

Project

Expenses |

Project

Expenses |

Net Annual

Cash Flow |

Years to

Discount |

Discounted

Value |

| Initial Costs |

$0 |

$2,500 |

-$2,500 |

0 |

-$2,500 |

| Year 1 |

$1,200 |

$200 |

$1,000 |

1 |

$952 |

| Year 2 |

$1,200 |

$200 |

$1,000 |

2 |

$907 |

| Year 3 |

$1,200 |

$200 |

$1,000 |

3 |

$864 |

| Year 4 |

$1,200 |

$200 |

$1,000 |

4 |

$823 |

| Net Present Value |

|

|

|

|

$223 |

Electronic Calculators or Manufacturer Provided Calculations

There are economic calculators available online. Many are downloadable spreadsheets. These tools are often far more robust than the simple models discussed above. They often include calculations of the net present value and rate of return for the project. Some account for the time value of money and can show the effect of tax incentives on the project. Many allow for O&M and per kWh electricity costs to rise at rates other than the expected general inflation rate. These tools are beneficial in that you are able to run a variety of scenarios to evaluate the proposed project under different assumptions. Manufacturers or dealers typically provide calculations on economic return as part of their project proposal package. These figures are intended to be tailored for your site and situation and may reflect specific details about your financing package or product that cannot be easily included in the generic calculations.

However, both the online calculators and manufacturer provided calculations are only as accurate as the assumptions being made in the calculations. Companies interested in selling you a product may select assumptions that shed the most favorable light on their product and not the assumptions that

most accurately reflect your situation. In order to determine if the economic return indicators provided are accurate for your situation, you need to check these assumptions. The following list of questions can aid you in this assessment:

- Is the energy consumption calculation for your site consistent with the information you obtained from your utility company? When calculating the appropriate size of your turbine, you should collect at least one-year’s worth of energy statements to get an accurate estimate of your annual kWh usage.

- What are the assumptions about your current cost of energy from the utility? You can obtain actual costs of energy for your site by contacting your utility company. In 2022, the average cost of electricity for residential customers in Maryland per kilowatt-hour was $0.1416.

- What assumptions are being made about energy price increases? Without major policy changes such as the regulation of greenhouse gas emissions, the US Energy Information Administration is currently projecting energy prices to increase at approximately 2.5 percent per year over the 2010 to 2035 period.

- What assumptions are being made about the turbine electrical generation? This question will require additional research on your part, and make certain that the energy output calculations are accurate. Many estimates and electronic calculators will assume maximum energy output from the turbine, which will overestimate the economic return calculation.

- What turbine life expectancy is assumed? Many calculations will assume an operational life of 20 to 30 years. While there are small wind turbines on the market that have been in operation for this amount of time, there are also many new turbines and new companies that do not yet have a 20 to 30 year product history. You may wish to ask the manufacturer or dealer for further information on testing or actual field performance of their turbines to ascertain if the life expectancy is realistic for your project. Some parts (such as the tower) of the system may have value after the project is complete. You may want to consider the life expectancy of the components in addition to the system as a whole.

- What assumptions are made with regard to O&M costs? Bear in mind that your O&M allocation should provide for replacement of parts over time. For example, if the inverter (which is typically assumed to have a life expectancy of 10 to 15 years and can cost between $1,000 and $3,000), the O&M allocation should be large enough to cover the cost of replacement. You may want to consider how the project analysis would change with a major component (such as an inverter) failure at some point during the project.

- What assumptions are being made with regard to the cost of the system? Detailed costs on the following system components should be included in the estimate

you receive from the manufacturer or dealer:

- Wind turbine cost

- Inverter

- Controller

- Batteries (only for off-grid applications)

- Tower (prices will vary by the height and type of tower)

- Tower erecting equipment

- Foundation materials

- Wiring and electrical supplies

- Labor for foundation, tower erecting, electrical wiring, and turbine installation

- Turbine and tower shipping

- Siting and permitting

- Sales or property taxes (if applicable)

- Insurance costs

- Does the economic calculation assume that any excess energy is being purchased and paid for by the utility (sometimes referred to as a buy-back rate)? In Maryland, net metered projects are compensated at the utilities avoided cost. These low rates generally do not make it economical to sell large amounts of excess energy to your electric utility.

- What is being assumed about your purchase of the system? Does the model assume that you will pay cash or obtain a loan? If debt financing is assumed, what interest rate and loan period are used? You may wish to check with your bank regarding appropriate interest rates. What down payment and collateral are being assumed? There are some renewable energy loan programs with low interest rates that might be assumed. Be sure to check with the program manager regarding loan availability and interest rates before assuming that you will qualify for any nonconventional lending program.

- What does the calculator assume about state and federal incentives? Not all programs will apply to your situation. Make certain that you verify which programs are being assumed in the calculator and review the program qualifications to ensure that you will qualify for the incentives before including them in your analysis.

- Are the operations and maintenance costs assumed to increase at the same rate as inflation or at some other rate? Does the model provide this functionality, and if so, what rate is being used? Discount rates are often included in electronic or manufacturer provided calculations. The discount rate is included in time value of money or net present value calculations. A discount rate of three to four percent is typical.

- Does the calculator make any assumptions about reducing demand charges? In general, small wind systems will have little effect on demand charges. A reasonable assumption is a monthly demand reduction equal to one-half of the capacity factor times the rated power of the turbine. In most residential applications, demand charge or service fee reductions should not be assumed.

- What assumptions are being made with regard to the sale of Renewable Energy Credits (RECs)? In some cases, wind turbine owners are able to sell the “renewable” aspects of their electrical production to utilities, companies or individuals who want or need to ensure that a portion of their electric usage is produced from renewable sources. This is very common for large projects but is much less common for small projects.

Economic returns may only be one consideration in your evaluation of a small wind system. However, whether you consider the payback period or return on investment to be your main priority, or only a passing consideration, understanding the information that is being presented to you is important. Critical evaluation of the assumptions that have been included in any economic calculations provided to you can ensure that the installed system meets your expectations and accomplishes your fiscal objectives.

English

English العربية

العربية Български

Български 简体中文

简体中文 繁體中文

繁體中文 Hrvatski

Hrvatski Čeština

Čeština Dansk

Dansk Nederlands

Nederlands Suomi

Suomi Français

Français Deutsch

Deutsch Ελληνικά

Ελληνικά हिन्दी

हिन्दी Italiano

Italiano 日本語

日本語 한국어

한국어 Norsk bokmål

Norsk bokmål Polski

Polski Português

Português Română

Română Русский

Русский Español

Español Svenska

Svenska Català

Català Filipino

Filipino עִבְרִית

עִבְרִית Bahasa Indonesia

Bahasa Indonesia Latviešu valoda

Latviešu valoda Lietuvių kalba

Lietuvių kalba Српски језик

Српски језик Slovenčina

Slovenčina Slovenščina

Slovenščina Українська

Українська Tiếng Việt

Tiếng Việt Shqip

Shqip Eesti

Eesti Galego

Galego Magyar

Magyar Maltese

Maltese ไทย

ไทย Türkçe

Türkçe فارسی

فارسی Afrikaans

Afrikaans Bahasa Melayu

Bahasa Melayu Kiswahili

Kiswahili Gaeilge

Gaeilge Cymraeg

Cymraeg Беларуская мова

Беларуская мова Íslenska

Íslenska Македонски јазик

Македонски јазик יידיש

יידיש Հայերեն

Հայերեն Azərbaycan dili

Azərbaycan dili Euskara

Euskara ქართული

ქართული Kreyol ayisyen

Kreyol ayisyen اردو

اردو বাংলা

বাংলা Bosanski

Bosanski Cebuano

Cebuano Esperanto

Esperanto ગુજરાતી

ગુજરાતી Harshen Hausa

Harshen Hausa Hmong

Hmong Igbo

Igbo Basa Jawa

Basa Jawa ಕನ್ನಡ

ಕನ್ನಡ ភាសាខ្មែរ

ភាសាខ្មែរ ພາສາລາວ

ພາສາລາວ Latin

Latin Te Reo Māori

Te Reo Māori मराठी

मराठी Монгол

Монгол नेपाली

नेपाली ਪੰਜਾਬੀ

ਪੰਜਾਬੀ Afsoomaali

Afsoomaali தமிழ்

தமிழ் తెలుగు

తెలుగు Yorùbá

Yorùbá Zulu

Zulu ဗမာစာ

ဗမာစာ Chichewa

Chichewa Қазақ тілі

Қазақ тілі Malagasy

Malagasy മലയാളം

മലയാളം සිංහල

සිංහල Sesotho

Sesotho Basa Sunda

Basa Sunda Тоҷикӣ

Тоҷикӣ O‘zbekcha

O‘zbekcha አማርኛ

አማርኛ Corsu

Corsu Ōlelo Hawaiʻi

Ōlelo Hawaiʻi كوردی

كوردی Кыргызча

Кыргызча Lëtzebuergesch

Lëtzebuergesch پښتو

پښتو Samoan

Samoan Gàidhlig

Gàidhlig Shona

Shona سنڌي

سنڌي Frysk

Frysk isiXhosa

isiXhosa